The financial services industry in the U.S. is witnessing rapid growth with digital transformation strategies taking the center stage. As per recent studies, 72% of American adults use mobile banking applications. On the other hand, 77% of financial, banking, and insurance claim transactions happen through digital channels. Thanks to the rapid adoption of mobile, web, and cross-platform FinTech apps that handle everything – from document processing and investment decisions to financial planning and roadmap creation.

No doubt, the success of this digital shift depends on FinTech applications and web platforms. However, these apps are prone to major challenges, such as data leaks, compliance violations, and performance complications. The only plausible solution to overcome these hiccups is effective FinTech software development backed by futuristic features, functionalities, and aspects.

But how do you, as a CFO, CEO, or CSO, finalize the FinTech app features that prove beneficial for your business growth without complexity? Not to worry, this blog post will help you answer this question and many more. It will assist you in going beyond contemplations and assumptions to build a more resilient finance ecosystem for users. Let’s begin!

8 Must-Have Features for Successful FinTech App Development

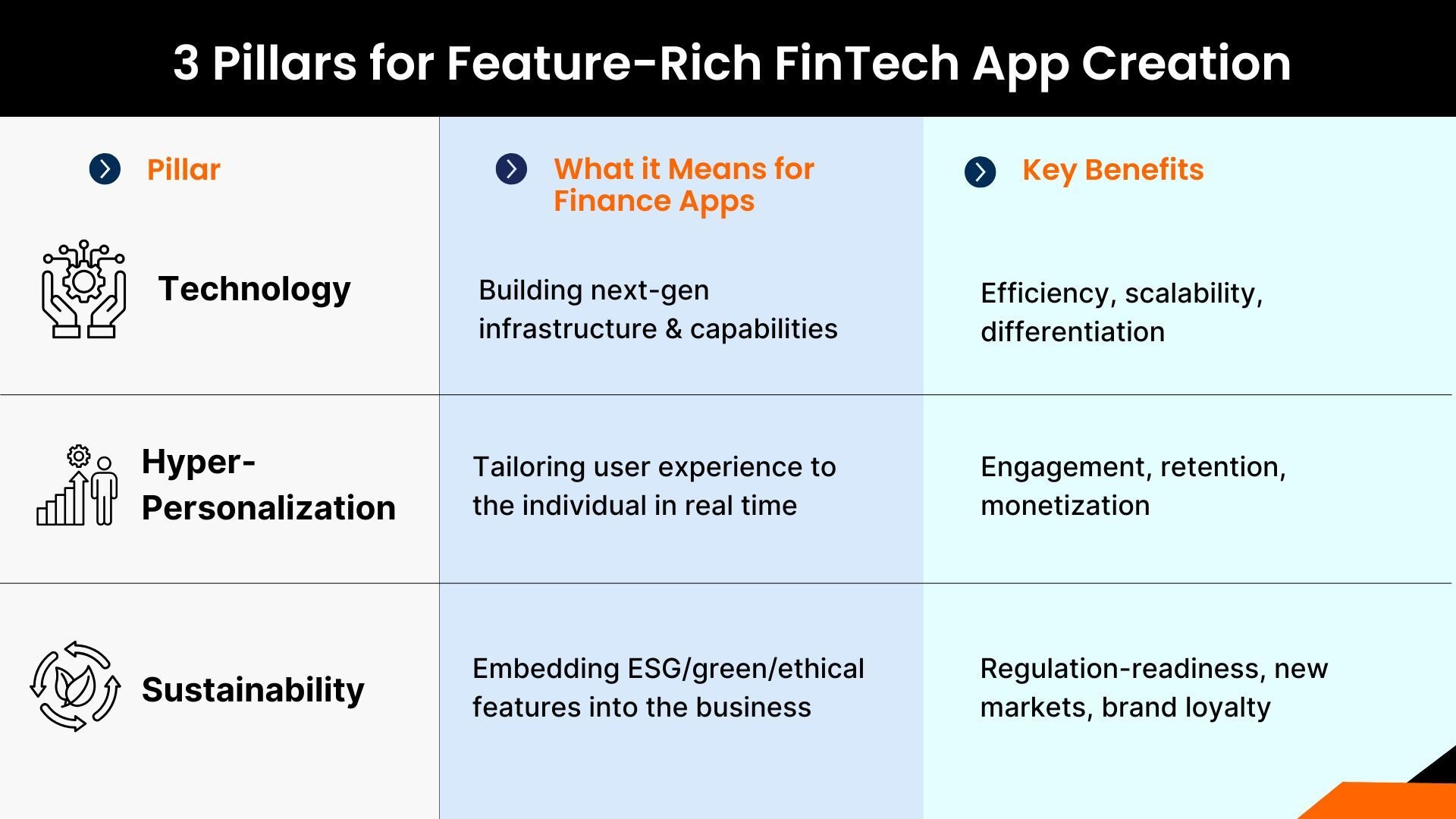

There are various features and functionalities that leading FinTech solutions providers offer to cater to their users' requirements. However, the real benefits are showcased by the ones that are built on at least one of the three pillars – Technology, Hyper-Personalization, and Sustainability.

Let’s take a look at these pillars one by one to give you a better idea.

Technology

In today’s competitive business environment, it’s essential that the features reflect the true essence of technology in financial application development. The features and functionalities should outline advanced digital capabilities and tools at their core. These may include AI, cloud strategy development, blockchain, data analytics, business intelligence, IoT, DevOps automation, and app modernization.

As per a Gartner study, 90% of finance operations will be driven by at least one AI-assisted technology solution by 2026. The study also suggests the increasing role of AI agents in data analytics, resource optimization, prescription & prediction, and query processing.

Technology-powered financial app features are aimed at automating critical operations, supplementing manual efforts, decreasing overhead costs, and maximizing business success. They provide enough scalability to accommodate growing users without compromising service quality.

For better understanding, let’s check out two powerful features trusted by top FinTech applications.

#1 Credit Scoring Backed by AI

This feature analyzes vast datasets to evaluate the creditworthiness of a particular user. It uses AI models and ML algorithms to identify credit risks beforehand with utmost precision. With this feature, finance solutions providers will be able to make better and more strategic decisions. On the other hand, users will be able to access accurate credit as per their finance pattern.

For instance, Upstart has incorporated AI models to discover creditworthiness, ensuring reliable lending options for users who are overlooked during the traditional/manual credit scoring process. Their approach helped them fast-track loan processing and reduce risks.

|

Know how Clarion helped insurance companies, credit card providers, and retail banks avoid financial losses by deploying an AI-powered fraud detection feature. This advanced feature improved fraud detection accuracy by 30% and reduced the rate of false positives to 20%. |

#2 Secure Transactions Using Blockchain

The feature uses a decentralized ledger that outlines completely transparent and well-protected P2P transactions. It supports an undisputed payment process to reduce financial fraud and improve monetary exchanges. With the help of Blockchain technology, this feature logs every transaction without raising any complexities.

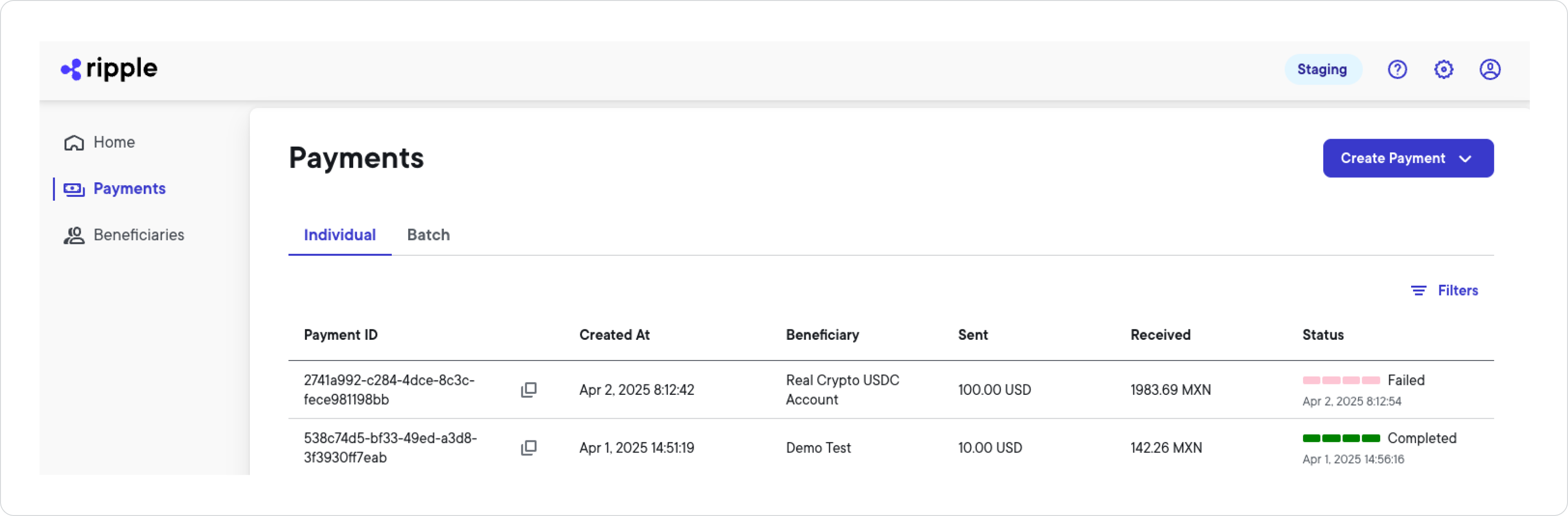

An effective example of a Blockchain-backed transaction feature used by a leading Finance app is Ripple. It enables cross-border transactions quickly and effectively. It ensures monetary exchanges without the need for any intermediate agents.

Hyper-Personalization

No user denies using a tailored service specific to their requirements. However, when it comes to a finance application, delivering user-centric services can be quite challenging. That’s when hyper-personalized features and functionalities can help. They combine the capabilities of behavioral data, historical response patterns, context analysis, and key preferences to efficiently cater to custom needs.

While generic FinTech features may get ignored, hyper-personalized aspects may lead to seamless adoption and user experiences. They can promote high-ROI products/services at the right time, thereby improving customer lifetime value (CLV). They can positively impact decision-making scenarios related to investments, payments, and transactions.

According to McKinsey, personalized experiences can help companies generate 40% more revenue than their competitors. On the other hand, IBM's report states that the global financial ecosystem is moving toward hyper-personalized banking features and services.

Here are 4 winning features of top-tier financial apps that harness the potential of hyper-personalization.

#3 Tailored Financial Advisory

AI agents and ML algorithms have the capabilities to provide customized financial suggestions. This feature analyzes user historical data, payment patterns, financial goals, and income ups/downs for dedicated financial planning. It enables users to properly save, invest, and prepare a budget that suits their financial positioning.

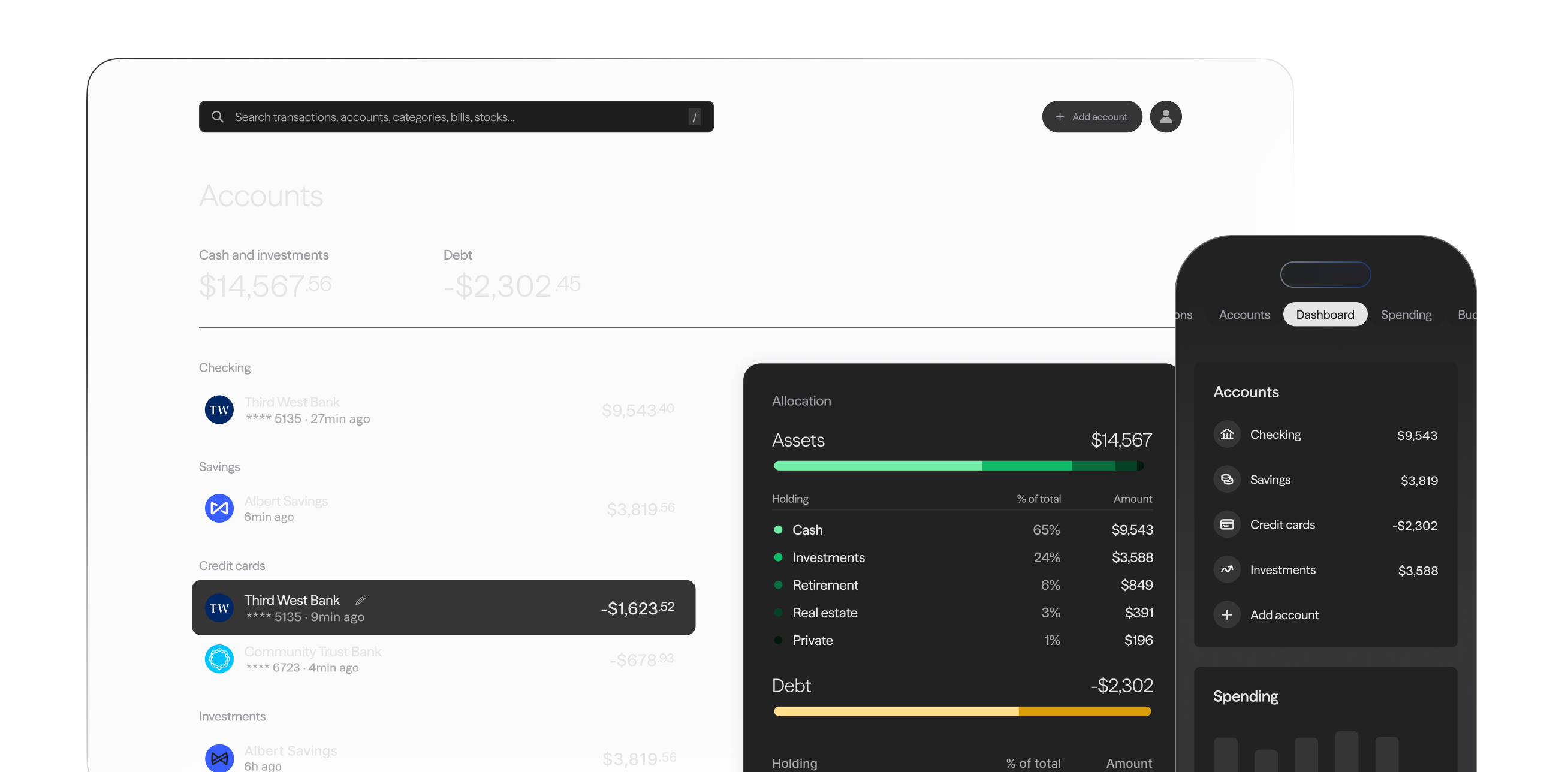

A renowned financial app, Albert offers a similar feature that helps users with hyper-personalized financial planning and assistance. It does this with the help of its virtual assistant, which observes spending patterns to meet specific financial goals. It suggests best practices to save and invest capital wisely in real time.

#4 Dynamic Pricing Feature

With this feature, financial solutions providers can explore real-time data like user behavior and their financial goals to provide interest rates, offers, and fees. It delivers custom financial schemes/products to incentivize users with the most competitive and relevant deal that resonates with their current finance activities.

The perfect example is SoFi with an in-built dynamic pricing feature that personalizes the loan process based on an individual’s payment history, credit score, and annual income. It provides dynamic offers and financial products to meet specific requirements and deliver a seamless user experience.

|

Discover how Clarion enabled finance solutions providers to streamline customer retention and sentiment analysis using a predictive customer analytics feature. Our FinTech app experts harnessed the power of Python ML libraries, such as NLTK, Scikit-learn, and TensorFlow, to decrease churn rates by 18%, improve customer engagement by 20%, and increase business revenue by 12%. |

#5 Personalized Investment Portfolio

AI algorithms play a pivotal role in providing a customizable investment portfolio feature that analyzes users’ finance preferences and risk tolerance capabilities. The portfolios are adjusted according to the current market conditions and individual progress, thereby ensuring tailored allocation of financial assets and other investment instruments.

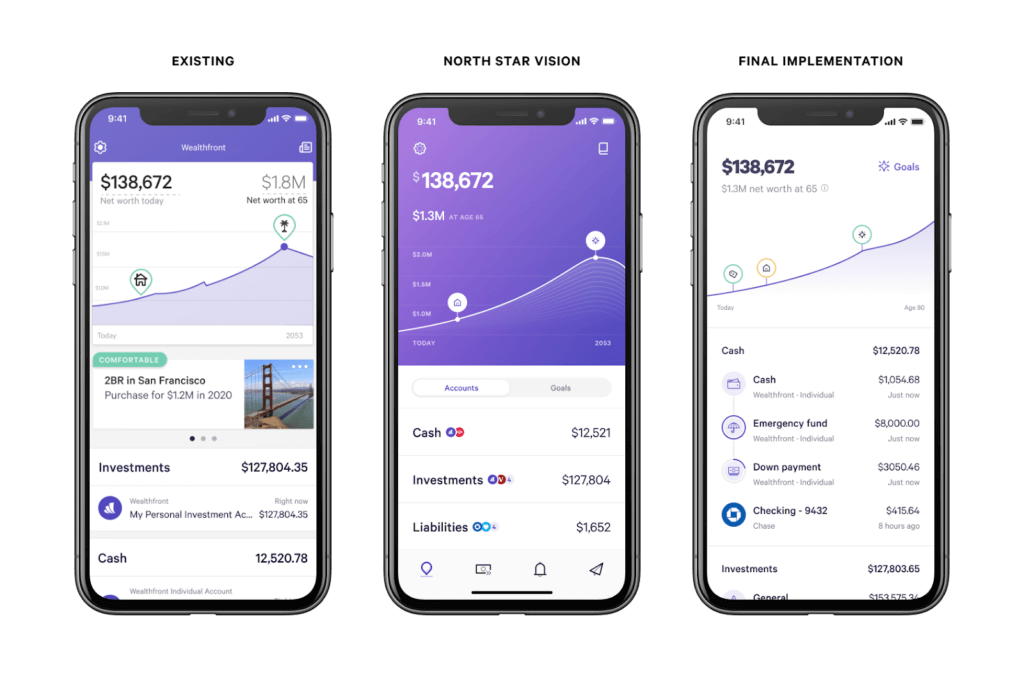

Wealthfront hosts a similar feature that creates tailored investment portfolios to meet the specific user requirements. This feature analyzes timeframes and risk tolerance of an individual to redefine existing portfolios as per evolving market conditions and investment opportunities.

|

Clarion assisted a financial institution in overcoming potential challenges like inefficient risk assessment, regulatory compliance complexity, and limited predictive insights by building a powerful predictive analytics feature. The feature improved risk prediction accuracy by 25% and reduced operational costs by 20%. |

#6 Real-Time Alerts & Notifications

This feature notifies users with crucial activities, such as due dates for bills, low balances, or large payments. These notifications can be tailored to alert users about various financial scenarios and events. It enables users to stay updated with their financial foundation and provides actionable insights to avoid unwanted and sudden risks.

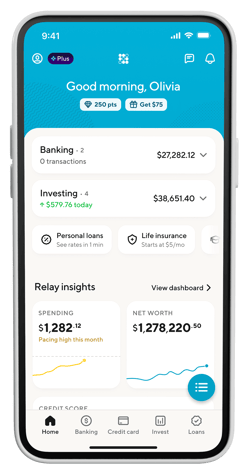

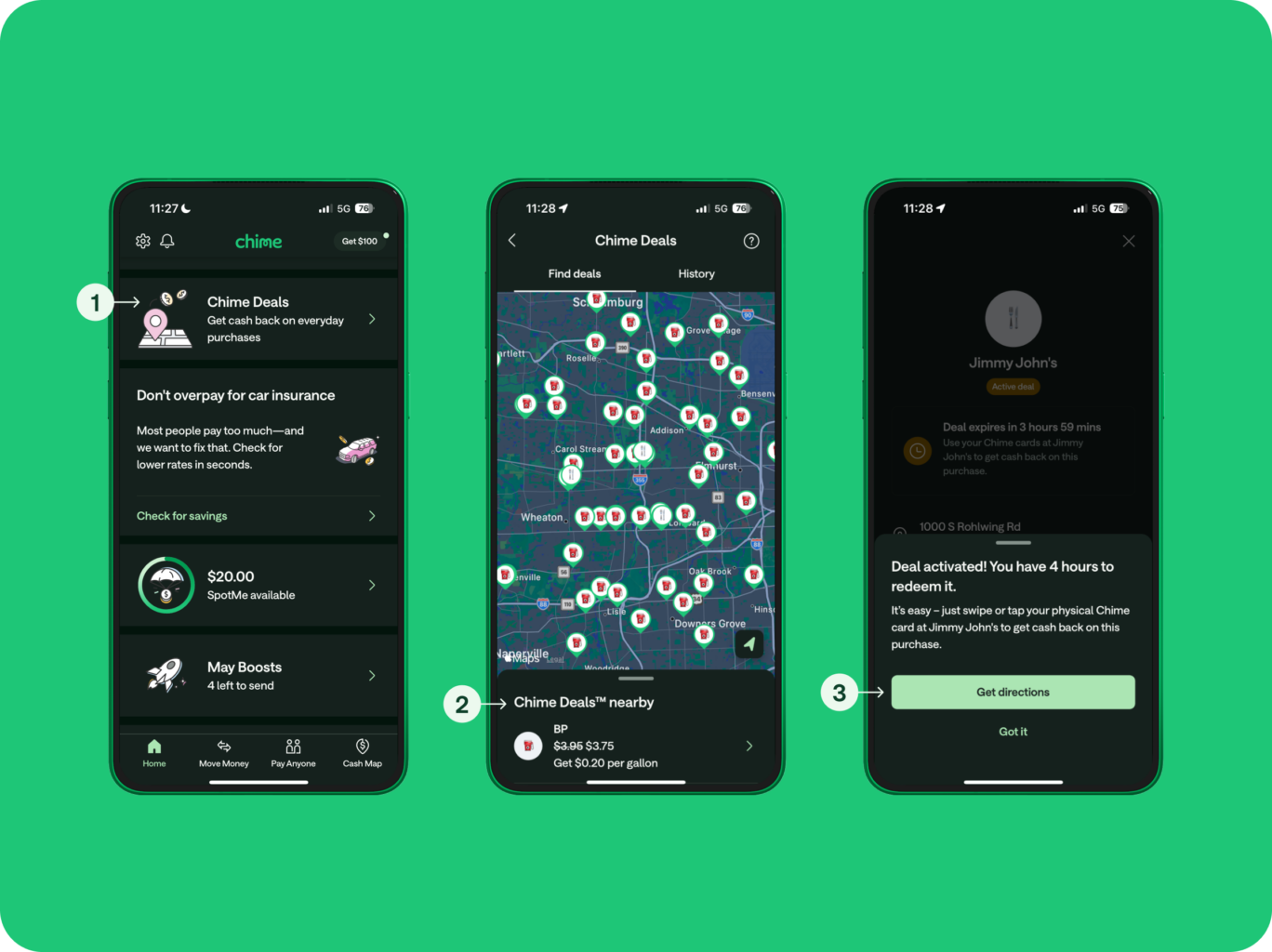

A similar feature is offered by Chime that notifies users about their funds, transactions, and future bills. The feature aims to generate alerts for streamlined account activities. It allows users to track their spending patterns, eliminate overdraft risks, avoid unwanted fees, and optimize finances.

Sustainability

It’s really important to focus on implementing finance application features and best practices that empower environmental, social, and governance (ESG) goals in the long run. Finance solutions providers need to introduce their financial applications with features that support ethical use of data, crucial FinTech regulations, carbon footprint reduction, and green digital infrastructure.

Research by IntellectAI suggests that the ESG FinTech market is anticipated to collect a whopping $123.7 billion by 2026. Another report by Zipdo claims that 35% of FinTech applications available across the market have started including features that present financial literacy for topics related to sustainability.

Financial applications with features that ensure low-carbon investment and cloud optimization while improving long-term customer loyalty are a must to dominate 2026. They can not only reduce costs but also avoid regulatory penalties.

To get a clearer idea, here are two solid features that can make your finance software development project a huge success.

#7 Carbon Footprint Monitoring

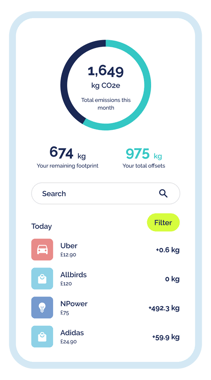

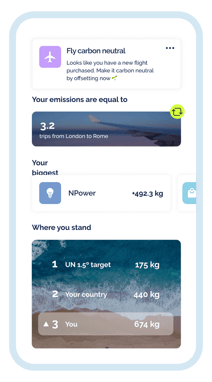

Businesses need to surely consider this feature while planning their FinTech software development. The feature provides detailed insights into how a user’s spending choices impact the environment. It analyzes payment information to highlight a particular acquisition's contribution to carbon emissions. It provides necessary recommendations to reduce carbon footprint and spend responsibly.

For instance, a similar feature is operational in the Yayzy application that monitors carbon emissions as to what users buy and gives instant insights on their carbon footprint. The feature improves the sustainable buying capabilities of users and how they can contribute to environmental safety.

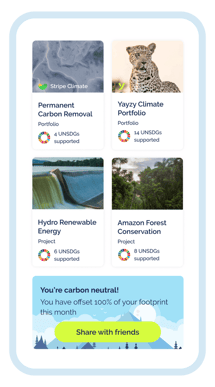

#8 Environment-Friendly Investment

As a CFO, it’s critical to assist users with investing in sustainable assets like green bonds, environmentally friendly companies, and renewable energy initiatives. That’s where this feature can help. It successfully aligns a user’s financial goals with capital investment in environmental sustainability opportunities. It aims to create a low-carbon economy.

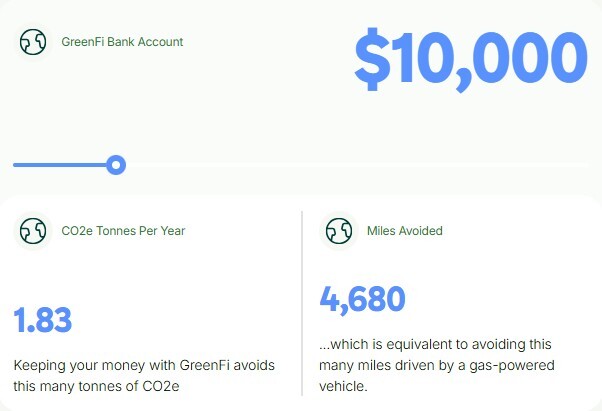

GreenFi app enables users to capitalize on environmentally responsible and green initiatives. Its sustainable banking feature prioritizes ethical banking. It focuses on monetary investments that support green consciousness and eco-friendly projects.

Kickstart Feature-Rich FinTech Application Development with Clarion

To take full advantage of the aforementioned features and functionalities, businesses need to collaborate with a trusted FinTech software development partner. This will help you build robust finance mobile applications and web platforms that maximize business ROI, enhance user engagement, and deliver top-notch quality services.

Do you have a specific feature in mind for your FinTech application? Are you looking to modernize your existing Finance app features? Is your company seeking a dedicated development team to build an AI-powered financial feature for your app? Get in touch with the top 1% FinTech software experts at Clarion to share your unique requirements and exceed business goals.

Author