U.S. banks and financial institutions have entered a new digital era. It’s marked by regulatory challenges, cyber risks, talent shortages, and growing fintech competition. Even CIOs, CTOs, and Heads of Digital in BFSI are under pressure to build faster, safer, and more scalable digital systems.

However, U.S. talent alone cannot meet the demand. It has brought offshore development for banking, even in India, back into focus with a new strategic approach. But outsourcing in financial services can’t rely on outdated models. Risk, compliance, and operational safety must lead the strategy.

This blog explores why banks outsource, what concerns they have, and how top institutions build safe offshore delivery models that accelerate transformation without risking compliance.

Why Banks Are Reconsidering Offshore

The objective of financial services leaders for outsourcing is not to cut costs but to get bigger, more capable engineering teams to stay competitive. Here’s what pressures them to push BFSI to embrace offshore development:

- Talent shortage (payments/AML/risk/core)

- Faster fintech-driven timelines

- Heavier compliance + security load

- 24×7 support needs

- Cost-to-income pressure

However, with India-based offshore teams working well for banks with strong BFSI domain expertise, teams can scale up or down quickly and deliver faster with clear governance and controls.

Outsourcing Concerns for BFSI Decision-Makers

U.S. banks and financial institutions (BFSI sector) are increasingly more cautious about outsourcing, particularly offshore development.

As technology continues to play a crucial role in the banking and financial services sector, BFSI executives are feeling the pressure to maintain control over their operations, data, and security. Here are the main concerns causing this shift:

#1 Compliance Breach

This is often the initial concern of BFSI teams. They’re aware that even a small non-compliance can result in audits, penalties, or harm to one’s reputation. When work is outsourced, most leaders want complete assurance that regulatory rules, data protection standards, and audit requirements won’t be violated.

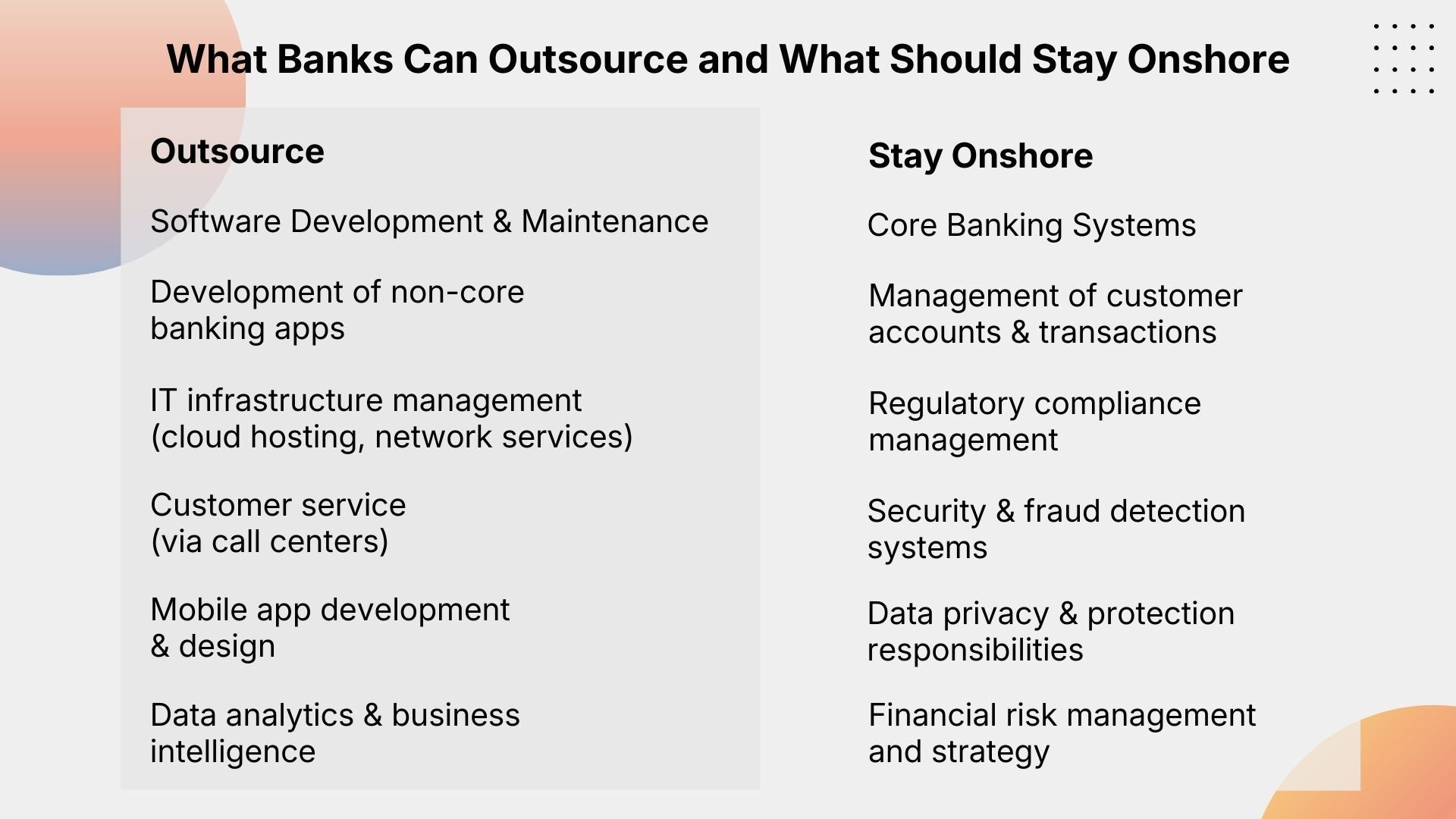

#2 Core Banking Systems Stay Local

Most decision-makers draw a clear line when it comes to core banking systems. Banks prefer to keep them close, where security, performance, and oversight are easier to manage as they fuel daily transactions and customer trust. Offshore teams usually support related fields, including analytics, digital apps, and integrations.

#3 Do not Lose Visibility or Control

BFSI leaders demand complete transparency, including strong governance, clear progress updates, access to environments, and defined ownership. This ideal setup seems like an extension of an in-house team, not a disconnected third party.

#4 Regulators will Scrutinize

Banks are aware that regulators will closely examine any offshore or outsourcing strategy. It involves clear documentation, risk management, vendor responsibility, and proof that the bank retains ownership of the results.

How Banks Decide What to Outsource and What to Retain

Banks don’t outsource everything, and they usually don’t decide based on cost alone. They succeed with outsourcing when they follow a modular model in which they only send the right workloads offshore. Here's how:

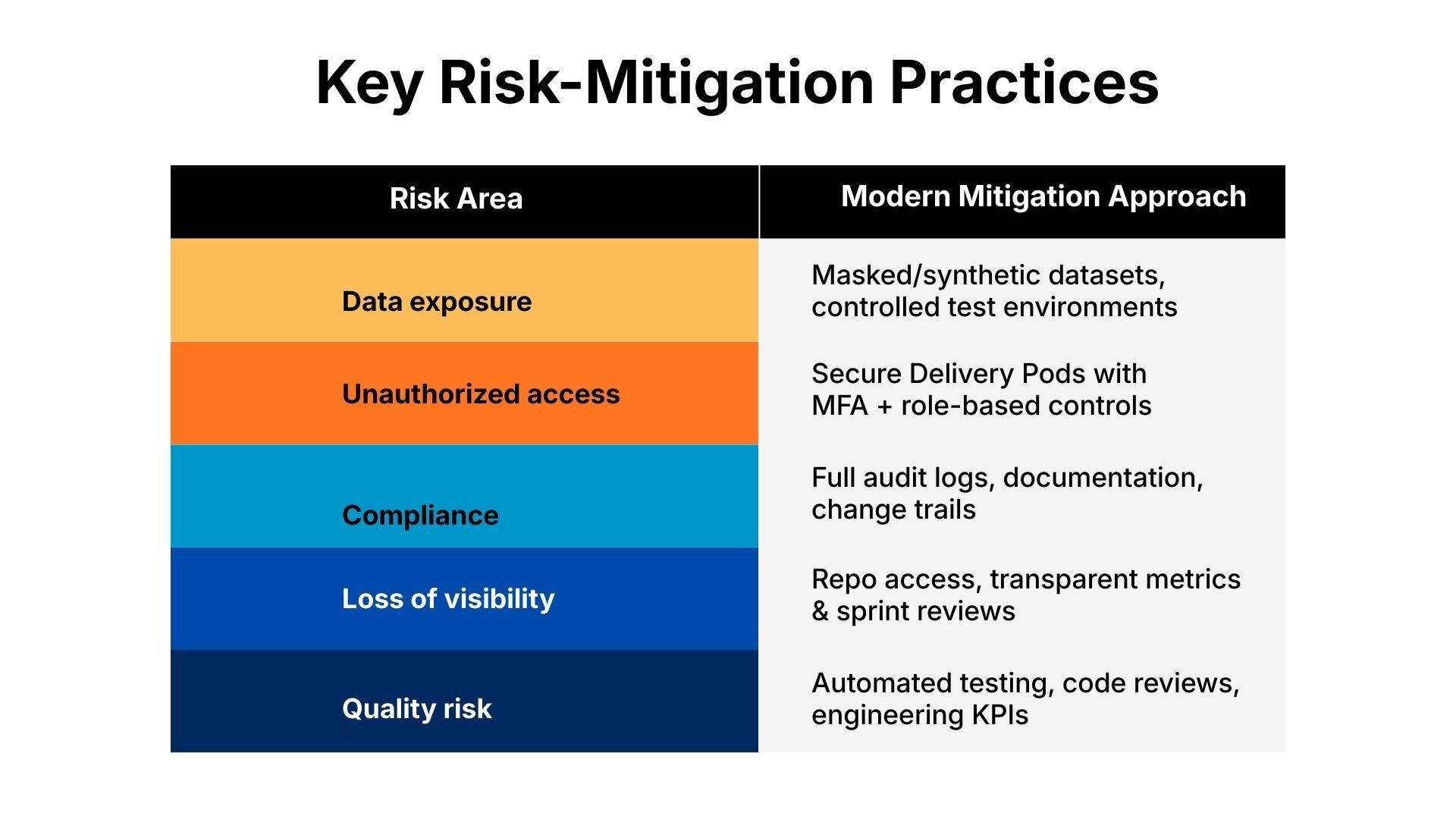

How Banks Are Making Offshore Engineering Safer in 2026

Modern offshore banking engineering looks very different from the 2000s outsourcing model. Leading institutions rely on secure BFSI delivery pods and compliance-first engineering.

These safeguards allow BFSI institutions to accelerate delivery without compromising security or compliance, as seen in multiple BFSI case studies.

Why India Remains the Most Trusted BFSI Engineering Hub

The cost-effectiveness is not the only reason banks and financial institutions choose India. Banks choose India because of its strong talent and delivery approach. Here’s what makes India stand out:

- 30+ years of BFSI engineering experience

- Huge talent base in banking, lending, AML/KYC, and payments

- Mature, security-first offshore delivery

- Proven follow-the-sun execution

- Scales multiple parallel projects with domain experts

That’s why many banks don’t see India as just a vendor location but treat it as an extension of their own technical team.

Ways Top-Tier Offshore Partners Deliver Banking Outcomes

You know why banks are reconsidering offshore development. Now, let’s discuss what the best offshore partners really do and how you can spot one for your bank and financial institutions. Some of the top traits of a high-maturity BFSI offshore partner:

- BFSI domain depth: payments, AML/KYC, lending, cards

- Compliance-led delivery: GLBA/PCI-ready, strong governance

- Zero-PII approach: tokenized + masked data, controlled access

- Secure setup: isolated pods, logs, MFA

- Transparent agile: sprint visibility, velocity, quality metrics

- Scalable BFSI pods: workflow-ready teams

- Audit-ready docs: solid internal + regulatory documentation

These aren’t generic outsourcing features. They usually come only after years of working in the financial services industry. Plus, you’ll be able to build quickly and consistently when you find a partner like this.

Consult Clarion for Offshore Development in BFSI

At Clarion, we provide expert offshore development solutions designed for the BFSI industry, ensuring that your technology strategies align with your business objectives.

Our skilled A-Players assess your existing setup, identify inefficiencies, and provide offshore solutions that maintain cost-effectiveness while putting security and legal compliance first. We offer practical and secure solutions for your banking requirements, whether you need to modernize your systems or integrate new technologies.

Plus, with our vEmployee™ model, you can collaborate with dedicated offshore developers who work as an extension of your team. This model guarantees seamless integration, helping you navigate offshore development challenges while maintaining strict quality and compliance standards. Get in touch with Clarion to utilize offshore development for your BFSI operations.